What Is Financial Wellness and How Can It Help Businesses?

Employee wellness is the foundation of every successful business. If business or HR leaders didn’t know that before the pandemic, they sure do now—especially after the Great Resignation.

Financial wellness is when you take control of your money so it doesn’t take control of you. That means budgeting, getting out of debt, saving and retiring with confidence. It’s not taking out loans, using credit cards, getting paycheck advances, or making risky investing moves.

Financial wellness is when you take control of your money so it doesn’t take control of you. That means budgeting, getting out of debt, saving and retiring with confidence. It’s not taking out loans, using credit cards, getting paycheck advances, or making risky investing moves.

Financial wellness is when you take control of your money so it doesn’t take control of you. That means budgeting, getting out of debt, saving and retiring with confidence. It’s not taking out loans, using credit cards, getting paycheck advances, or making risky investing moves.

They have control over their day-to-day finances.

They have enough cushion to handle most financial emergencies.

They are out of debt and able to manage their expenses without swiping a credit card.

They are on track to meet their savings and retirement goals.

Employee wellness is the foundation of every successful business. If business or HR leaders didn’t know that before the pandemic, they sure do now—especially after the Great Resignation.

Financial wellness is essential for companies that want to offer a benefit that helps the long-term financial futures of their employees and their company’s bottom line at the same time.

Financial wellness benefits help employees where they’re hurting the most—their wallets. If you can help your employees manage their finances, you’ll see better engagement, retention and productivity.

Ramsey Solutions conducted a study of more than 3,000 employees working at organizations with 25 to 3,000 employees. The study covered topics including employee benefits, perceptions of and engagement with financial wellness benefits, employee financial and mental health, and other trends impacting today’s workforce.

Ramsey Solutions conducted a study of more than 1,000 benefits decision-makers in companies of all sizes across the United States. The study covered topics ranging from financial wellness benefits, the impact of financial wellness, barriers to financial wellness, organizational health and the impact of COVID-19.

Here are some key findings from the SmartDollar 2022 Employee Benefits Study where 3,000 employees were surveyed.

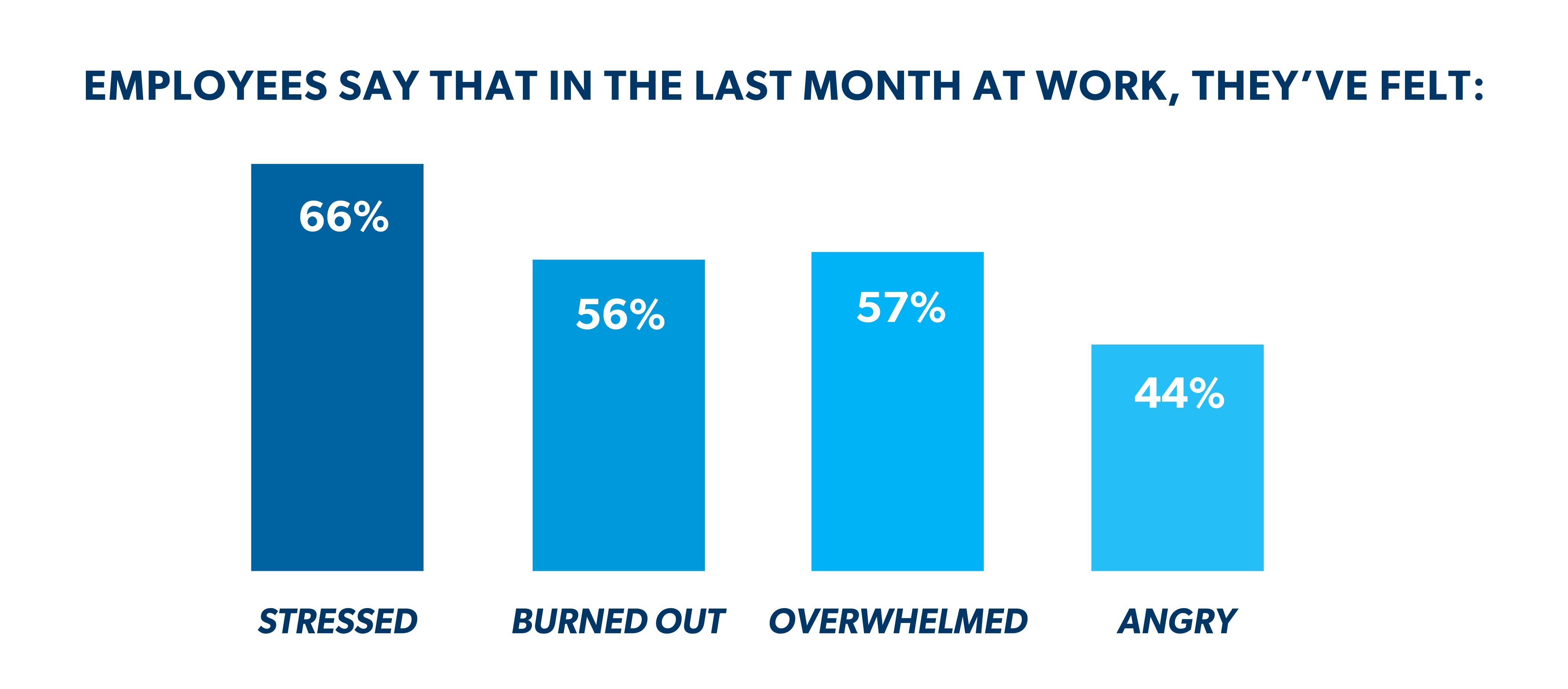

Employees Are Stressed, Burned Out, Overwhelmed And Angry

The 2022 SmartDollar Employee Benefits Study

Employees Worry About Personal Finances Daily

The 2022 SmartDollar Employee Benefits Study

Money Is The #1 Cause Of Stress

The 2022 SmartDollar Employee Benefits Study

Employees’ Mental Health Is Impacting Their Work

The 2022 SmartDollar Employee Benefits Study

Compensation Is The #1 Reason Employees Are Leaving

The 2022 SmartDollar Employee Benefits Study

Employees Are Losing Sleep Over Personal Finances

The 2022 SmartDollar Employee Benefits Study

Financial wellness is when you take control of your money so it doesn’t take control of you. That means budgeting, getting out of debt, saving and retiring with confidence. It’s not taking out loans, using credit cards, geting paycheck advances, or making risky investing moves.

Over half (55%) of employees say they worry about their personal finances daily.1 Businesses can play a crucial role in helping their employees achieve financial wellness. How? By offering financial wellness benefits that help employees budget, get out of debt, save, and retire with confidence.

Your employees’ money problems don’t stay personal—they follow your employees into work, too. And offering a financial wellness benefit to employees helps reduce the business costs associated with their financial stress—things like missed work, lost productivity and employee turnover. Learn more here.

The best financial wellness programs help employees get on a budget, get out of debt, save for the future, and retire with confidence. There’s just no substitute for true financial wellness. Learn how you can help your employees win with money using SmartDollar.